A financial adviser is someone who offers financial advice to clients. You must be trained and registered with a regulatory body to pursue this career. The career is expected to grow at a rate of around 4% between now and 2029. It is estimated that there will be over one million people working in the field of financial services by that time.

Projections for job growth of financial advisors between 2029-2029 are around 4%

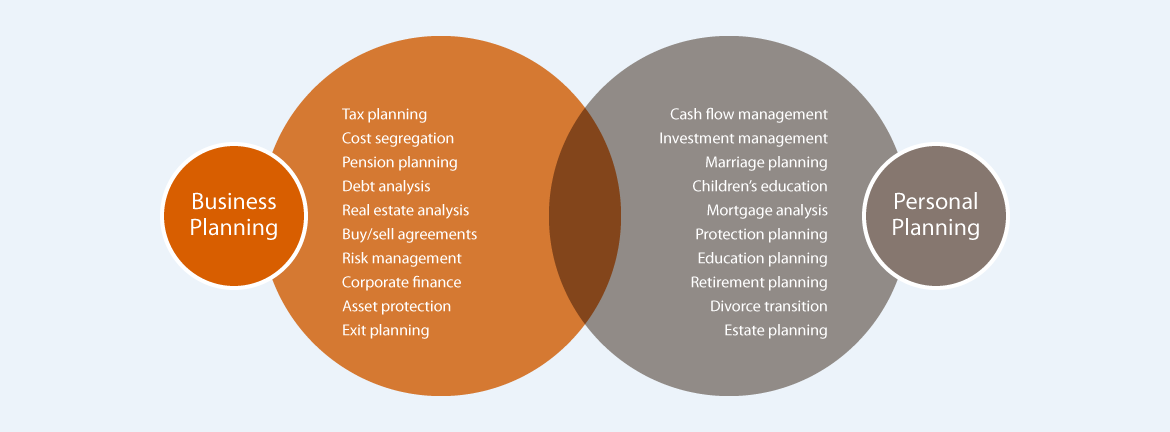

Americans need financial advisors to help them make sound financial decisions. Pandemic stressors and unemployment have increased interest in the financial market, which will make financial advisors an even more important part of the future. Financial advisors perform many tasks, including helping clients to create a budget and choosing investment strategies.

A career as financial advisor requires keen analytical skills. Financial advisors need to be able analyze data and project future performance. Financial advisors must communicate well with clients to build trust and relationships. They must be able communicate effectively and have excellent listening and public speaking skills.

Requirements to become a financial advisor

There are many licensing requirements and requirements to be a financial advisor. In order to sell securities and insurance products, financial advisors must complete a FINRA registration and pass certain exams. These multiple-choice exams usually last 75 minutes to three hours. For specifics on which exams and licenses are required for different roles, visit FINRA's website.

A financial advisor may work for a large company, a small company, or independently. They spend most of their working hours advising clients and developing financial solutions. They may review existing client plans. Financial advisors may not need a college education, but some have been certified through on-the job training.

Job duties

Financial advisors perform many duties to assist clients in achieving their financial goals. They create and update financial plans, educate clients about various financial options, and stay abreast of market trends and news. They create investment strategies to diversify client's portfolios and minimize risk. Financial advisors may offer seminars to assist clients in learning about various financial planning options.

The job of a financial advisor requires analytical thinking and skills in data analysis. Future performance projection skills are also required by a financial advisor. Professionals must also be capable of analyzing and assessing the client's needs and goals. These skills require excellent communication skills. Financial advisors need to be able build trust with clients and follow industry ethics.

Salary

Financial advisors make a living by calculating the value of client portfolios. Compensation typically includes a base salary plus bonuses and incentive compensation. Advisors can also receive bonuses for the acquisition of new assets. The average annual salary for an associate financial adviser is $94,000. Lead advisors are paid over $165,000 per annum and have a wide range of responsibilities that include client relationship management, business development, and client relations management.

Financial advisors can earn a wide range of compensation. It tends to increase with experience. The size and ability of an advisor's business, as well as their client portfolio, will impact the amount they make. For example, the top-quartile of Service advisors earn approximately $25,000 more than their peers. The top-quartile Lead advisors make almost $100,000 more than their peers. The highest-paid Practicing Partners are paid over twice as much.

FAQ

What are the various types of investments that can be used for wealth building?

There are several different kinds of investments available to build wealth. Here are some examples.

-

Stocks & Bonds

-

Mutual Funds

-

Real Estate

-

Gold

-

Other Assets

Each one has its pros and cons. Stocks and bonds, for example, are simple to understand and manage. However, they can fluctuate in their value over time and require active administration. Real estate on the other side tends to keep its value higher than other assets, such as gold and mutual fund.

Finding something that works for your needs is the most important thing. Before you can choose the right type of investment, it is essential to assess your risk tolerance and income needs.

Once you have determined the type of asset you would prefer to invest, you can start talking to a wealth manager and financial planner about selecting the best one.

How do I start Wealth Management?

The first step towards getting started with Wealth Management is deciding what type of service you want. There are many types of Wealth Management services out there, but most people fall into one of three categories:

-

Investment Advisory Services. These professionals will assist you in determining how much money you should invest and where. They can help you with asset allocation, portfolio building, and other investment strategies.

-

Financial Planning Services - This professional will work with you to create a comprehensive financial plan that considers your goals, objectives, and personal situation. Based on their professional experience and expertise, they might recommend certain investments.

-

Estate Planning Services - An experienced lawyer can advise you about the best way to protect yourself and your loved ones from potential problems that could arise when you die.

-

Ensure that the professional you are hiring is registered with FINRA. You can find another person who is more comfortable working with them if they aren't.

How does Wealth Management work?

Wealth Management allows you to work with a professional to help you set goals, allocate resources and track progress towards reaching them.

Wealth managers not only help you achieve your goals but also help plan for the future to avoid being caught off guard by unexpected events.

They can also prevent costly mistakes.

What is retirement planning?

Planning for retirement is an important aspect of financial planning. You can plan your retirement to ensure that you have a comfortable retirement.

Retirement planning is about looking at the many options available to one, such as investing in stocks and bonds, life insurance and tax-avantaged accounts.

Is it worth hiring a wealth manager

A wealth management service should help you make better decisions on how to invest your money. It should also help you decide which investments are most suitable for your needs. This will give you all the information that you need to make an educated decision.

There are many factors you need to consider before hiring a wealth manger. You should also consider whether or not you feel confident in the company offering the service. Is it possible for them to quickly react to problems? Can they explain what they're doing in plain English?

Statistics

- US resident who opens a new IBKR Pro individual or joint account receives a 0.25% rate reduction on margin loans. (nerdwallet.com)

- These rates generally reside somewhere around 1% of AUM annually, though rates usually drop as you invest more with the firm. (yahoo.com)

- As previously mentioned, according to a 2017 study, stocks were found to be a highly successful investment, with the rate of return averaging around seven percent. (fortunebuilders.com)

- A recent survey of financial advisors finds the median advisory fee (up to $1 million AUM) is just around 1%.1 (investopedia.com)

External Links

How To

How to invest your savings to make money

You can earn returns on your capital by investing your savings into various types of investments like stock market, mutual fund, bonds, bonds, real property, commodities, gold and other assets. This is called investment. It is important to understand that investing does not guarantee a profit but rather increases the chances of earning profits. There are various ways to invest your savings. These include stocks, mutual fund, gold, commodities, realestate, bonds, stocks, and ETFs (Exchange Traded Funds). These methods are discussed below:

Stock Market

The stock market is one of the most popular ways to invest your savings because it allows you to buy shares of companies whose products and services you would otherwise purchase. Also, buying stocks can provide diversification that helps to protect against financial losses. If the price of oil falls dramatically, your shares can be sold and bought shares in another company.

Mutual Fund

A mutual fund is an investment pool that has money from many people or institutions. They are professionally managed pools of equity, debt, or hybrid securities. The investment objectives of mutual funds are usually set by their board of Directors.

Gold

It has been proven to hold its value for long periods of time and can be used as a safety haven in times of economic uncertainty. It can also be used in certain countries as a currency. In recent years, gold prices have risen significantly due to increased demand from investors seeking shelter from inflation. The supply-demand fundamentals affect the price of gold.

Real Estate

Real estate refers to land and buildings. When you buy realty, you become the owner of all rights associated with it. Rent out part of your home to generate additional income. You can use your home as collateral for loan applications. The home may be used as collateral to get loans. However, you must consider the following factors before purchasing any type of real estate: location, size, condition, age, etc.

Commodity

Commodities can be described as raw materials such as metals, grains and agricultural products. Commodity-related investments will increase in value as these commodities rise in price. Investors looking to capitalize on this trend need the ability to analyze charts and graphs to identify trends and determine which entry point is best for their portfolios.

Bonds

BONDS ARE LOANS between governments and corporations. A bond can be described as a loan where one or both of the parties agrees to repay the principal at a particular date in return for interest payments. If interest rates are lower, bond prices will rise. A bond is bought by an investor to earn interest and wait for the borrower's repayment of the principal.

Stocks

STOCKS INVOLVE SHARES OF OWNERSHIP IN A COMMUNITY. A share represents a fractional ownership of a business. If you own 100 shares of XYZ Corp., you are a shareholder, and you get to vote on matters affecting the company. When the company earns profit, you also get dividends. Dividends can be described as cash distributions that are paid to shareholders.

ETFs

An Exchange Traded Fund is a security that tracks an indice of stocks, bonds or currencies. ETFs trade just like stocks on public stock exchanges, which is a departure from traditional mutual funds. The iShares Core S&P 500 eTF (NYSEARCA – SPY), for example, tracks the performance Standard & Poor’s 500 Index. Your portfolio will automatically reflect the performance S&P 500 if SPY shares are purchased.

Venture Capital

Venture capital is private financing venture capitalists provide entrepreneurs to help them start new businesses. Venture capitalists can provide funding for startups that have very little revenue or are at risk of going bankrupt. Venture capitalists invest in startups at the early stages of their development, which is often when they are just starting to make a profit.